Budget-Conscious Vehicle Shoppers Want to Keep it Simple, Study Finds

With new vehicle prices rising and tariffs creating further chaos, it's not the easiest of times for consumers who want to stay out of the used market yet spend as little as possible in the new one. As a result, automakers will have to be creative in streamlining their current offerings and doing all they can to maintain affordability.

This is one of the key findings of AutoPacific's latest study, which surveyed over 14,000 new vehicle intenders in the U.S. about their interest in more than 160 features and technologies.

- Also: This is Where You’ll Find the Cheapest Used Cars in Canada

- Also: Ram’s Money Boss Admits Brand Sorely Needs Cheaper Trucks

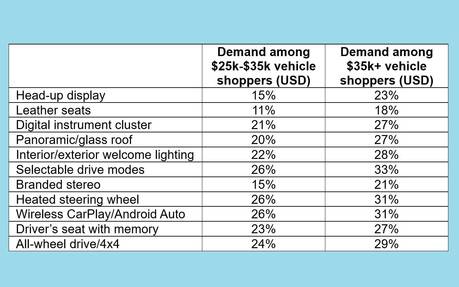

Basically, simplicity is what shoppers who plan to spend less than $35,000 USD (approx. $48,000 CAD) on their next new vehicle want. Upgrades like nicer, plusher seat upholstery choices, flashy exterior styling enhancements and more immersive cabin technology just aren’t as desirable for these people, as the following table highlights:

While many of the features above lack strong demand, they’re commonly found on popular vehicles that carry MSRPs within that coveted $25k-$35k USD price bracket, as AutoPacific points out. A number of them could likely be removed to lower a vehicle’s total cost and consequently improve affordability.

“Front wheel drive, base stereos, cloth seats with various manual adjustment and analog gauges are “in” for these more frugal shoppers,” says Robby DeGraff, AutoPacific’s manager of product and consumer insights, “so the array of standard equipment found on entry- and mid-level trims of today’s popular vehicles within the [lower] price range may need to be reexamined as consumers tighten their belts in the face of economic uncertainty.”

At the same time, people shopping for a lower-priced vehicle show much less interest in driver assistance features, according to AutoPacific, while the auto industry as a whole seems to believe it's its duty to include as many as possible.

“It’s good for models in that price range to offer some fancier, lower-demand features, but those should be optional and limited to higher trim levels, which can also serve to capture customers of bigger and nicely-equipped models who may be downsizing into more affordable segments as they tighten their belts,” says Ed Kim, AutoPacific’s president and chief analyst.

In related news, an annual report from S&P Global recently showed that interest and adoption in subscription-based connected car services and software has declined for the past two years, with customers either reluctant to pay the fees or concerned about their security and privacy.